The strategic control of oil assets by Central African states, notably in Gabon and Chad, presents a remarkable opportunity to advance national sovereignty, stimulate revenue growth, and encourage robust sustainable development. Drawing inspiration from the Norwegian model, where prudent management of natural resources facilitated the establishment of the Government Pension Fund Global, it is possible to demonstrate the positive impact of such an initiative on a country’s long-term financial stability.

The case of Saudi Aramco, which successfully expanded its control over assets initially owned by Exxon, Mobil, and Texaco, reveals the effectiveness of a gradual strategy. When applied judiciously, this approach can prove strategic. However, it is essential to adopt transparent, responsible, and high-performing management policies, prioritizing sustained local participation, to optimize the benefits arising from such acquisitions.

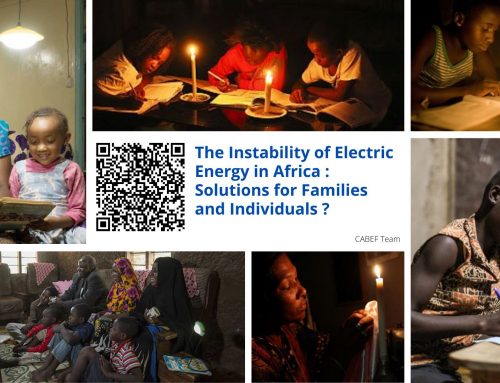

The vision of a sub-regional market advocated by the Central Africa Business Energy Forum (CABEF) represents a significant strategy for stabilizing sales despite market fluctuations. Bilateral or multilateral agreements between countries can strengthen the management of oil assets and mitigate the risks of revenue decline due to underinvestment.

The focus on increasing Gross Domestic Product (GDP) rather than mere development acknowledges the direct effect of oil revenues on the national economy. Investing in the industrial expansion of the oil sector can generate significant added value, thereby fostering sustained economic growth.

Ultimately, the control of oil assets presents a promising path towards increasing national sovereignty, revenue growth, and promoting economic prosperity, provided it is based on prudent policies and exemplary practices, while encouraging regional collaboration.

Keywords: National sovereignty, Revenue growth, Sustainable development, Local participation.

Nathalie LUM,

Chairwoman of CABEF.

Laisser un commentaire